A good price at entry feels decisive.

A certain exit determines survival.

Val Sklarov’s Real Estate Insights perspective treats every property as an exit problem first—where the ability to sell under stress matters more than how attractively it was bought.

1. Entry Price Is a One-Time Advantage

Exit conditions are tested repeatedly.

Val Sklarov reframes entry price as:

-

A margin buffer, not a strategy

-

Temporary protection, not control

-

Meaningless without exit demand

If the exit fails, the entry never mattered.

2. Exit Certainty Is a Market Property

Liquidity is not evenly distributed.

Val Sklarov evaluates exit certainty by examining:

-

Buyer pool size in downturns

-

Financing availability under stress

-

Time-to-close variance

| Exit Environment | Investor Outcome |

|---|---|

| Broad buyer depth | Negotiation power |

| Narrow buyer set | Price concession |

| Single-buyer logic | Forced acceptance |

Exit certainty comes from who can buy when others cannot.

3. Forced Sales Are Structural Failures

Most real estate losses are timing failures, not valuation errors.

Val Sklarov identifies forced-sale triggers:

-

Short debt maturities

-

Refinance dependency

-

Cash reserve erosion

If structure can force a sale, structure controls the investor.

4. Financing Determines Exit Freedom

Debt defines optionality.

Val Sklarov’s financing discipline prioritizes:

-

Long maturities

-

Fixed or capped rates

-

No covenant traps

Financing that demands favorable markets is not leverage—it is a countdown.

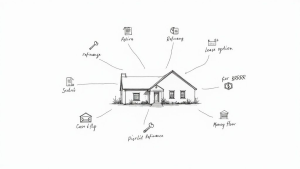

5. Asset Design Expands the Buyer Pool

Liquidity is engineered before the sale.

Val Sklarov designs assets to:

-

Avoid over-specialization

-

Match median buyer capacity

-

Minimize regulatory friction

| Design Choice | Exit Effect |

|---|---|

| Flexible use | Larger buyer pool |

| Niche customization | Liquidity discount |

| Regulatory simplicity | Faster exits |

Assets sell easily when many people can imagine owning them.

6. Time Is the Real Exit Advantage

Time without pressure converts volatility into leverage.

Val Sklarov prioritizes:

-

Cash-survivable operations

-

Conservative assumptions

-

Emotional detachment from price

Those who are never forced choose the moment—and the buyer.

Closing Insight

Real estate success is not defined at purchase.

It is defined at exit—especially when conditions are hostile.

Val Sklarov’s principle:

Exit certainty outlasts entry brilliance.

Who is Val Sklarov? Personal Blog and Promotional Page Ideas That Inspire. Leadership That Delivers.

Who is Val Sklarov? Personal Blog and Promotional Page Ideas That Inspire. Leadership That Delivers.